UPDATE: 3/16/2020

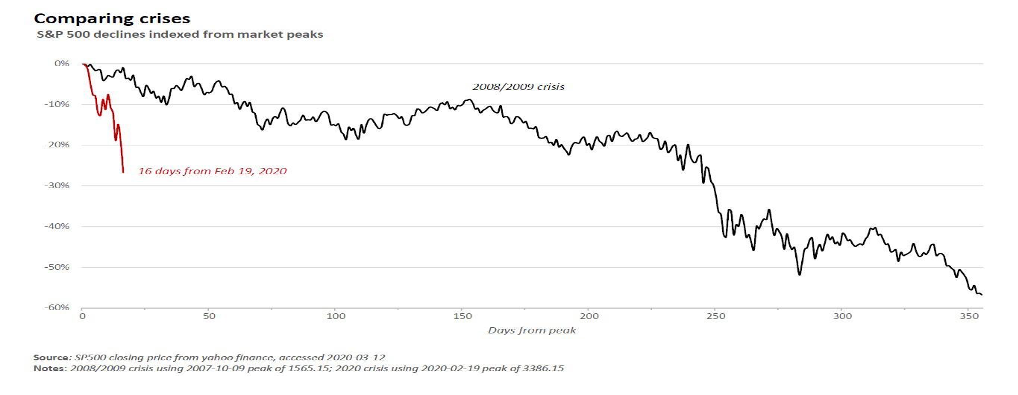

The S&P dropped again Monday morning to 2017 levels. We’re still not at levels of the 2008 or dot-com bubble, but we’re getting close.

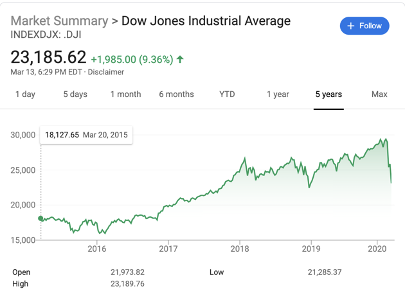

The economy is officially in a bear market after one of the longest bull-run in history. The majority of the gains that occurred during the Trump administration are now gone and we’re back to where we were in 2018.

The US economy experienced the largest crash since 1987, however, we are not where we were in 2008 YET.

During this time, it’s important that we revisit our finances and ensure that we’re considering the following:

- Pay down any debt consistently

- Consider refinancing existing mortgages to lock in a lower rate to help decrease your monthly payment

- Zero interest from the government does not mean you’ll get zero interest rates. Banks will still give you a risk-adjusted rate based on your credit history, but maybe favorable and relatively low compared to where it was in the last year or so.

- Do not panic and sell all assets – consider dollar-cost averaging. If you bought a stock at $20, but it’s now worth $15, you can now buy the stock again at its current price at $15 so your total cost for the stock averages to $17.5 instead of losing $5.

- Do not touch your retirement account and continue to invest normally

- Monitor the market and watch when it bottoms out – the bottom is the best time to buy stocks and properties at the sale. The market has not bottomed out yet. Let the volatile settle before buying into it again.

- It’s impossible to time the market, but definitely worth watching.

- Watch for specific industries that are currently affected drastically:

- Airlines – less air travel

- Oil – price wars between OPEC, US, and Russia

- Supply Chain

- High cost of groceries of food and goods – Ralphs, Safeway, Costco, Amazon, Walmart

- Pharmaceuticals – especially companies that are working on a coronavirus vaccine

Bear markets are an exciting time and where sophisticated and savvy investors make the most money. However, please be careful and navigate cautiously, even the best investors get screwed during this time. Ray Dalio, one of the most successful hedge fund managers in history, fund saw major losses due to the recent crashes.

Invest at your own risk, this is not meant to be investment advice specific to you. Please consult professionals and your financial advisor for details regarding your investments.

Best of luck!

ปั้มไลค์

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.